Table of Contents

The electronic trading landscape is changing quickly. MarketView’s timely, data-driven insights will help you stay ahead of the market structure evolution.

The growth of electronic trading and regulators’ push for more transparent markets have increased the availability of high-quality market data. However, gathering, normalizing and making sense of that data remains a challenge.

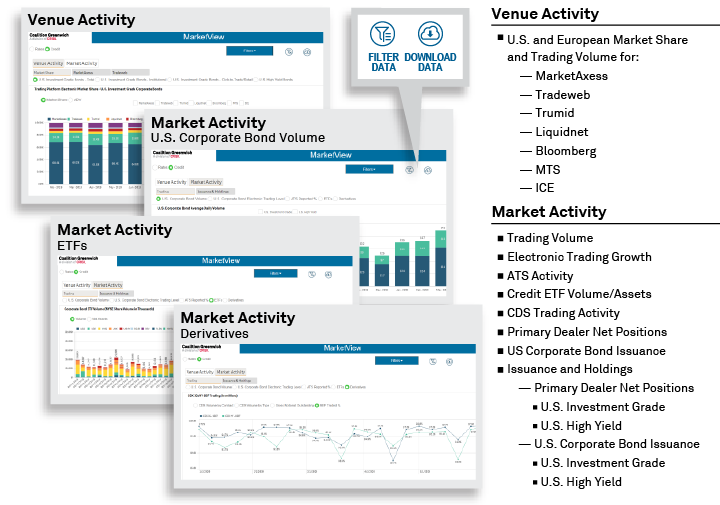

MarketView combines unique research from Coalition Greenwich, publicly available market data and the insights of our analyst team to quantify the growth of electronic trading in fixed-income and FX markets. The results include trading-platform market share and electronic trading trend data with a level of accuracy not available anywhere else.

Our list of customers includes sell-side traders, buy-side traders, trading-venue strategists, product managers and buy-side equity analysts covering the progress of global exchanges and trading venues.

Greenwich MarketView Rates Data

Greenwich MarketView Credit Data

March Spotlight: Client E-Trading of U.S. Treasuries Hits New Record

March 2024

March 2020 was the highest volume month in the history of the U.S. Treasury market with the average daily notional volume (ADNV) hitting $944 billion.

March Spotlight: Rotation into Bonds Drives Record Volume

March 2024

Are you wondering if the growth of corporate bond electronic trading in the past decade limits its growth in the next 10 years.